By Dr Majid Khan (Melbourne):

Akhuwat Foundation, founded in Lahore in 2001 by Dr. Muhammad Amjad Saqib, has grown into the world’s largest interest-free microfinance initiative, advancing a values-based model of poverty alleviation rooted in qarz-e-hasana (compassionate lending). Its core proposition is deceptively simple: remove interest, embed lending in community institutions (often mosques/churches), keep costs ultra-low, and require social collateral instead of physical collateral. Two decades on, the model has scaled nationally, drawn international recognition, and produced measurable socio-economic gains for low-income households.

Scale and Reach

By April 2025, Akhuwat Foundation reported crossing PKR 230 billion in cumulative disbursements, reaching over 6 million families across Pakistan—an expansion unmatched in the interest-free space.

Earlier snapshots illustrate how fast the curve has risen. Public profiles and academic overviews in recent years described several million loans and hundreds of billions of rupees in cumulative portfolios, with nationwide operations spanning hundreds of locations—evidence of sustained, broad-based outreach rather than isolated pilots.

A Distinct Operating Model

Akhuwat Foundation’ model departs from conventional microfinance in five ways:

- Zero interest, social collateral. Loans are extended without interest or traditional collateral; group endorsement and community vetting underpin repayment discipline.

- Community-based delivery. Disbursements and follow-ups are frequently organized through places of worship and community spaces, strengthening trust and accountability.

- High recovery. Multiple sources—organizational interviews and media reporting—consistently note 99–99.9% recovery rates, far above many market comparators.

- From borrowers to donors. A signature idea is reciprocity: once steady, many beneficiaries contribute back, creating a virtuous, community-financed pool.

Measured Impact, Not just Activity

Akhuwat’s claims are not only administrative tallies; they’ve been subjected to independent evaluation:

- Randomized field experiments in partnership with researchers found positive returns from interest-free microcredit among Pakistani micro-enterprises, with credible designs that tracked firms receiving Akhuwat loans and measured outcomes such as profits and investment.

- A recent peer-reviewed study (2022) again reported returns to interest-free microcredit using randomized assignment, strengthening the evidence base beyond observational data.

- Additional applied research explores poverty reduction channels (absolute, moderate, relative) under Akhuwat’s Islamic microfinance mode, suggesting welfare effects in income smoothing, food security, and education.

While impact magnitudes vary across contexts, the breadth of studies specific to the Akhuwat model is unusually strong for an NGO in the Global South.

Beyond Credit: A Multidimensional Anti-poverty Platform

Recognizing that poverty is multi-cause, Akhuwat has seeded complementary programs in education (including a fee-free college/university initiative), healthcare access, clothing banks, and support to transgender communities. These investments aim to lock in income gains and dignity beyond the loan cycle.

The organization has also mobilized quickly in crises. Following Pakistan’s 2022 floods, Akhuwat’s relief and rebuilding work was documented in Mawakhat: Stories of Resilience and Rebuilding after the 2022 Floods, launched with the Institute of Strategic Studies Islamabad in February 2025—capturing the program’s role in household recovery narratives.

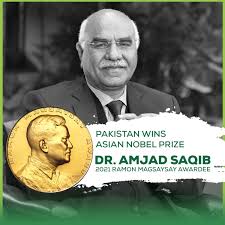

International recognition and platforms

Akhuwat and its founder have been recognized by leading international institutions:

- Ramon Magsaysay Award (2021). Often dubbed “Asia’s Nobel Prize,” the Award honored Dr. Amjad Saqib for transformational leadership that turned qarz-e-hasana into a mass movement.

- World Economic Forum profile. Akhuwat has been profiled as a pioneering, financially sustainable approach to microfinance, highlighting the scale of its interest-free portfolios and business formation among borrowers.

- Islamic Development Bank / Global policy fora. Akhuwat has been featured as a case of interest-free Islamic microfinance with a nationwide footprint, placing the model within broader South-South policy exchanges.

- Global media coverage. International outlets have reported on Akhuwat’s “largest interest-free” distinction and values-driven methodology, amplifying the model to non-Pakistani audiences.

These platforms matter: they normalize interest-free microfinance within mainstream development discourse, open doors to replication, and validate the approach before skeptical policy and donor circles.

Why the Model Works

- Values and incentives align. Removing interest, sharing space with community institutions, and emphasizing dignity reframes the borrower–lender relationship from transactional to relational. Borrowers are stakeholders, not clients, and social capital disciplines repayment more effectively than punitive pricing.

- Cost discipline enables scale. Lean operations and volunteerism, documented in cost studies; stretch donated rupees further, lowering the breakeven volume per branch and making outreach to small, dispersed borrowers financially feasible.

- Evidence-compatible design. Randomized trials show that when micro-enterprises do get capital, especially without the drag of interest—investment and earnings can rise. Akhuwat’s pipeline taps exactly that constraint.

- Reciprocity locks in sustainability. The “borrowers-to-donors” norm deepens ownership and replenishes capital, reducing reliance on perpetual external funding.

Governance and Risk

High recovery rates are not an accident. They flow from tight appraisal, group responsibility, and frequent contact rooted in neighborhoods and congregations. Organizational histories indicate that recovery has remained above 99% for years—an outlier in global microfinance—while media interviews with leadership have reiterated a 99.9% figure. The rate is not a guarantee (macroeconomic shocks can stress any portfolio), but it reflects persistent, system-level discipline rather than one-off performance.

Policy Relevance and Replication

Akhuwat’s journey has policy implications beyond Pakistan:

- Pro-poor finance without interest is viable at scale. The combination of community screening, lean cost structures, and values-compatible products can reach millions without eroding repayment.

- Hybrid public–philanthropic models work. Partnerships with provincial and federal authorities (e.g., for youth enterprise or housing support) have allowed Akhuwat to on-lend public funds with its community-based discipline—a template for social programs seeking efficiency and dignity.

- Evidence base supports scaling. The presence of randomized evaluations and operational research lowers the risk for policymakers considering replications or adaptations in other Muslim-majority and interest-sensitive contexts.

Limitations and the Road Ahead

No model is a panacea. Interest-free microcredit is not a substitute for infrastructure, education reform, or social protection; it complements them. Moreover, as portfolios expand, governance risks (mission drift, credit concentration, cyber/IT systems) require professionalization without losing the volunteer ethos. Research should keep probing heterogeneity of impacts—who benefits most (by sector, gender, location), optimal loan sizes, and the role of complementary services (training, markets). The encouraging news is that Akhuwat’s ecosystem has embraced research partnerships, making continuous learning part of the DNA.

Conclusion

Akhuwat demonstrates that finance infused with empathy can scale, remain financially disciplined, and deliver measurable welfare gains. With PKR 230 billion disbursed to 6 million families, exceptionally high repayment, and recognition from major international institutions, Akhuwat has turned a faith-anchored ideal into an operationally rigorous platform that helps households climb the first rungs out of poverty. For countries wrestling with the costs and ethics of lending to the poor, Akhuwat’s experience is not merely inspirational, it is an evidence-backed, policy-relevant blueprint.