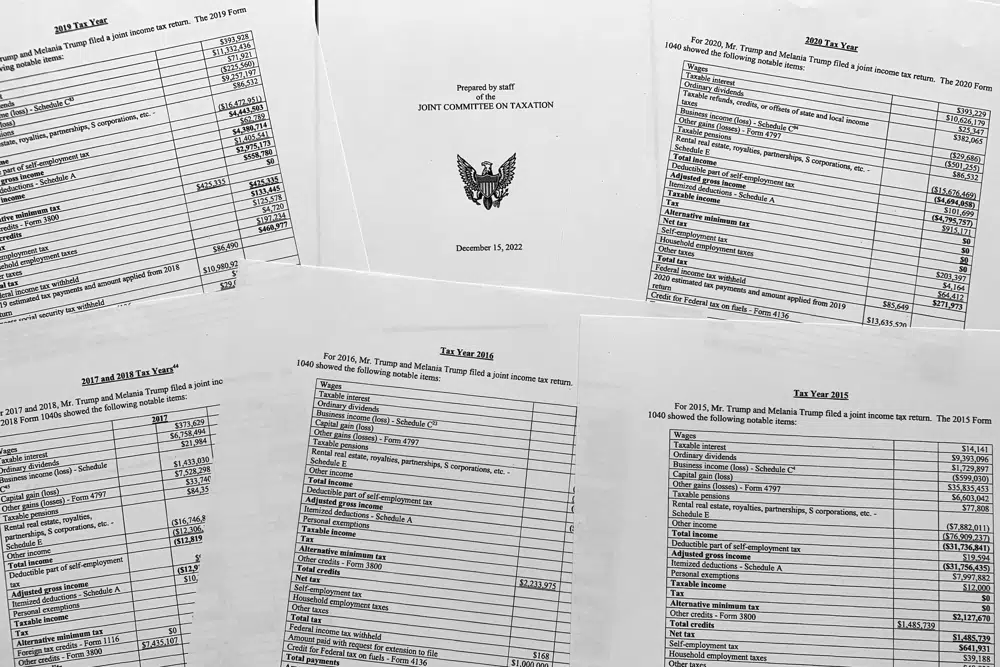

WASHINGTON (AP) December,22— An IRS policy governing the audits of tax returns filed by U.S. presidents is under new scrutiny after a report published by a congressional panel found the agency failed to perform the mandatory inspection of Donald Trump’s returns until Congress pressed for information about the process.

The three-point policy states that individual returns for the president and the vice president are subject to mandatory review, “should always be kept in an orange folder,” should be kept from the eyes of IRS employees and “should be locked in a secure drawer or cabinet when the examiner or reviewer is away from the work area.”

The report released Tuesday by the Democratic majority on the House Ways and Means Committee said the process, which dates to 1977, was “dormant, at best” during the early years of the Trump administration. Democrats in Congress are responding by introducing legislation that would codify the IRS policy into law with more stringent requirements.

Tax experts say the failure to launch the audit earlier is emblematic of a larger problem regarding the IRS’ capacity to examine high-income taxpayers’ returns — and a reminder of Trump as a norm-defying president.

John Koskinen, who served as IRS commissioner during both the Obama and Trump administrations, said the policy has been out of the public eye because presidents have traditionally released their tax-return summaries to the public. The recent submission of Trump’s tax returns to Congress is the culmination of a year-long legal battle between Trump and Democratic lawmakers.

His new $80 billion cash injection through the Inflation Reduction Act is expected to fix the struggling agency’s understaffing, outdated technology, and a host of other problems. But Republicans, who are looking to take control of the House within two weeks, say they want to cut those funds.

A commission report on Tuesday revealed that the IRS had just begun reviewing Trump’s 2016 tax returns on April 3, 2019, a date that coincides with lawmakers. The chairman of the committee, Massachusetts Democrat Richard Neal, has asked the IRS for information about Trump’s tax returns.

The report’s findings prompted lawmakers to recommend legal requirements for mandatory audits of presidential taxes, along with “timely disclosure of certain audit information and related tax returns.”

The issue highlights frustration with the so-called tax gap, the difference between what is due and what is paid to the federal government. According to his IRS data released in October, the estimated average total tax gap is $540 billion annually from 2017 to 2019.

Treasury Secretary Janet Yellen reiterated in various speeches in August that the new funds provided by Congress would be used to increase scrutiny of high net worth individuals, businesses and complex pass-throughs.

Enforcing the IRS’s policy on mandatory presidential reviews requires well-trained agents, forensic scientists, tax accountants, and others to conduct presidential reviews as complex as Trump involving hundreds of companies, properties, and complex business interests. must be supervised. A congressional report highlighted a shortage of staff and the availability of experts to study Trump’s taxes. According to the report, the IRS believed he had an attorney and an accounting firm to represent him, so the accuracy of his filings was assured.

The question of whether the president’s tax documents should be disclosed is another topic being debated among tax experts and lawyers.