ASTANA,kazakhstan.Dec 28(The Astana Times)– Kazakhstan has emerged as the top investment destination in North and Central Asia, attracting $15.7 billion in new projects, according to the latest report by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) released on 25 December. This figure represents an 88% year-on-year increase and accounts for 63% of all investments in the region.

Kazakhstan as a leader in the subregion.

Investment inflows into North and Central Asia grew by 27% to $24.8 billion in 2023.

“The growth in Kazakhstan now sees it attracting 63% of the region’s total FDI thus far in 2024, led by investments totalling $11 billion from Qatar’s UCC Holding to establish two gas processing plants, a new compressor station, and two additional trunk gas pipelines throughout the country,” the report notes. QazaqGas, the national gas company, and Qatar’s UCC Holding signed key agreements during President Kassym-Jomart Tokayev’s visit to Qatar. Among these projects are two gas processing plants with capacities of one billion and 2.5 billion cubic metres annually to enhance raw gas utilisation, a new compressor station, the Aktobe-Kostanai gas pipeline, and the second line of the Beineu-Bozoi-Shymkent pipeline.

“In this context, proactive investment promotion by line ministries and investment promotion agencies (IPAs) becomes increasingly crucial, particularly in sectors contributing to sustainable development. For emerging investment destinations, success depends not only on creating the right policy environment but also on offering investors a comprehensive suite of support services and aftercare,” the report reads.

Trends in North and Central Asia

Other countries showing robust investment trends include Uzbekistan ($4 billion), the Kyrgyz Republic ($2.1 billion), Azerbaijan ($1.2 billion), Turkmenistan ($339 million), Georgia ($126 million), and Armenia ($67 million).

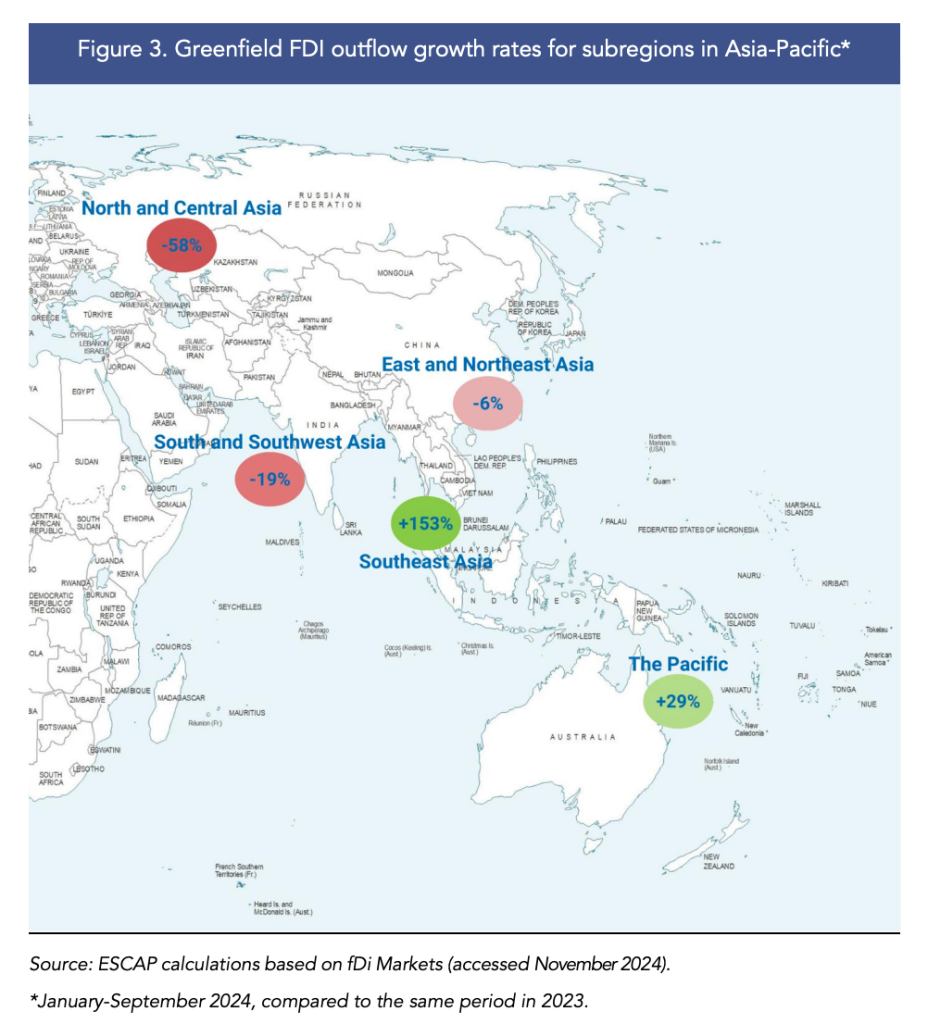

Outward investment from the subregion declined in 2024, following a recovery in 2023. The report indicates that total outflows fell by 58% to $2.3 billion, with Russia accounting for 90% of this amount, or $2.1 billion. Russian investors directed $847 million into India and Belarus’s coal, oil, and gas sectors.

Investment Patterns in Asia-Pacific

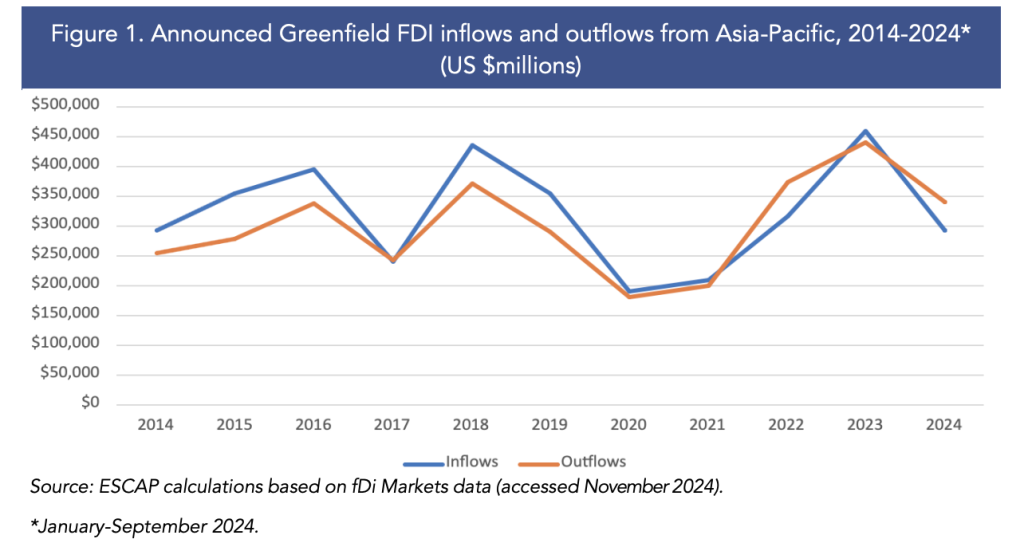

Foreign Direct Investment (FDI) in the Asia-Pacific region reached $292 billion from January to September this year, a $14 billion decline compared to $339 billion in the same period in 2023. Leading recipients were India ($76 billion), Australia ($38 billion), China ($28 billion), and Japan ($25 billion).

“The landscape of foreign direct investment (FDI) in Asia-Pacific continues to evolve rapidly amid global economic uncertainties, geopolitical shifts, and technological transformations. While 2024 has witnessed some moderation in investment flows following the record-breaking announcements of 2023, the region has demonstrated remarkable resilience and maintained its position as a premier destination for international capital,” the report states. Investors are adjusting to a “new normal” driven by enduring shifts in global markets and politics. Key drivers include accelerated digital economy investments post-COVID-19, a stronger emphasis on energy security, supply chain restructuring amid geopolitical tensions, and the mainstreaming of industrial policies.

Experts highlight two key investment trends – a more cautious evaluation of new opportunities compared to the initial surge of reactive investments and a natural slowdown in investment pace as 2023 projects transition to implementation, with corporate stakeholders closely monitoring outcomes and impact.

Sectoral Trends

According to the report, most inward FDI in the Asia-Pacific region went to the services sector, which accounted for 40-50% of the total. The share of the extraction and manufacturing sectors has fluctuated. As of September, the manufacturing sector accounted for 41% of total FDI in Asia-Pacific, while the services sector made up 55%. The share of the primary sector dropped to 4% in the first three quarters of 2024, down from 9% in the same period in 2023.

Kazak

“Within the manufacturing sector, the top sectors targeted in the first three quarters of 2024 were the semiconductor, electronic components, and metals sectors, attracting $28.2 billion, $19 billion, and $12.5 billion,” the report reads.

Although metals remained the leading manufacturing sector in 2023, investments in the first three quarters of 2024 declined by 61% compared to the same period in 2023. The report indicates that this decline stems from sluggish global steel demand, falling steel prices, heightened Chinese steel exports at lower costs, and reduced domestic consumption.